One of the most important tools used by media buyers and by brand managers when they negotiate with TV channels is to repeatedly refer to the ‘excess inventory’ available. To reinforce their statement, references are made to the ‘almost 800 channels’ that are broadcast and that advertisers could choose from.

On the surface of it, the argument seems correct to the media salesperson, and, with the ‘excess inventory’ playing heavily on his or her mind, the salesperson drops the effective rate.

Excess inventory is a big, fat myth.

It might be a fact that there are close to 800 channels, but how many of these 800 channels are able to attract viewership? The only ad inventory that matters is the inventory on channels that consumers watch.

When a product is an FMCG brand, it makes sense to play safe and advertise only on those channels that register decent viewership, it’s safe to assume.

How many channels do these brands consider? How many channels should they consider?

This question has been bothering me for some time, so I requested Partho Dasgupta, CEO, Broadcast Audience Research Council (BARC) to help with data. I had only one question for him:

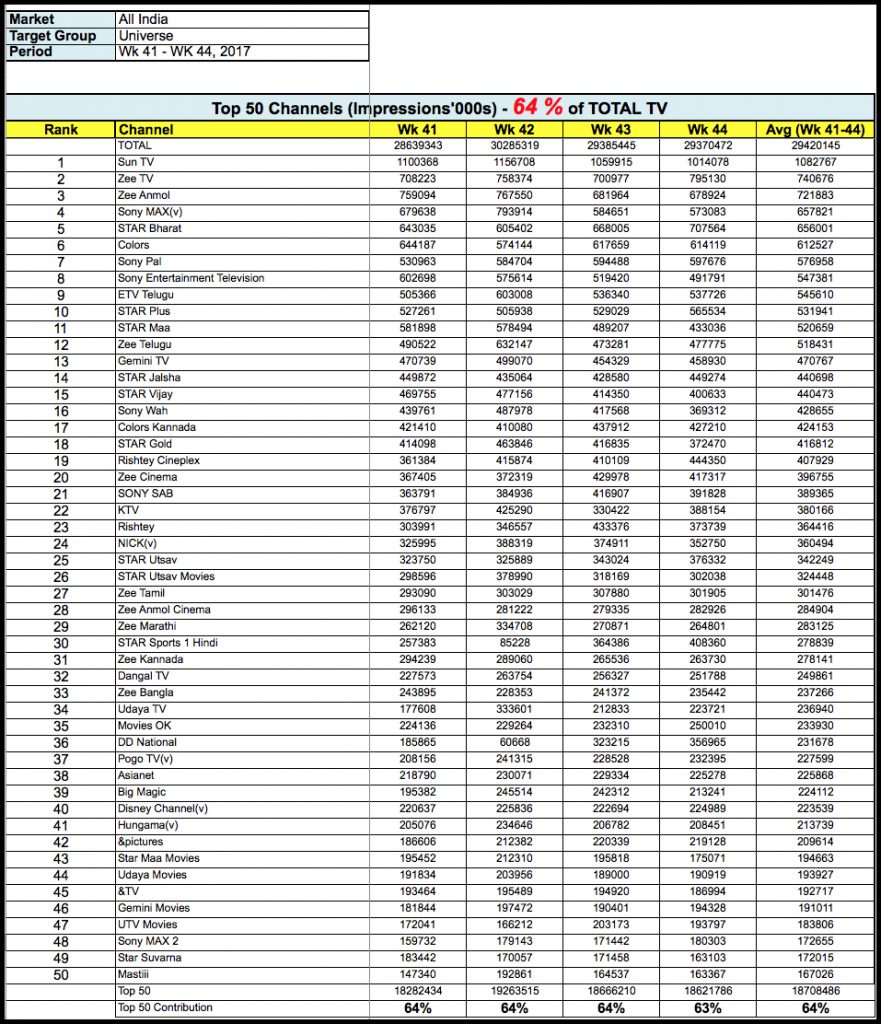

1. What is the percentage of GRPs delivered by 50 best performing TV channels?

The answer is not very different from what I had instinctively believed it would be: Sixty-four percent.

Just 50 out of the almost 800 channels that are beamed into Indian households deliver 64 percent of all the GRPs. On the flip side, 750 channels share the remaining 36 percent.

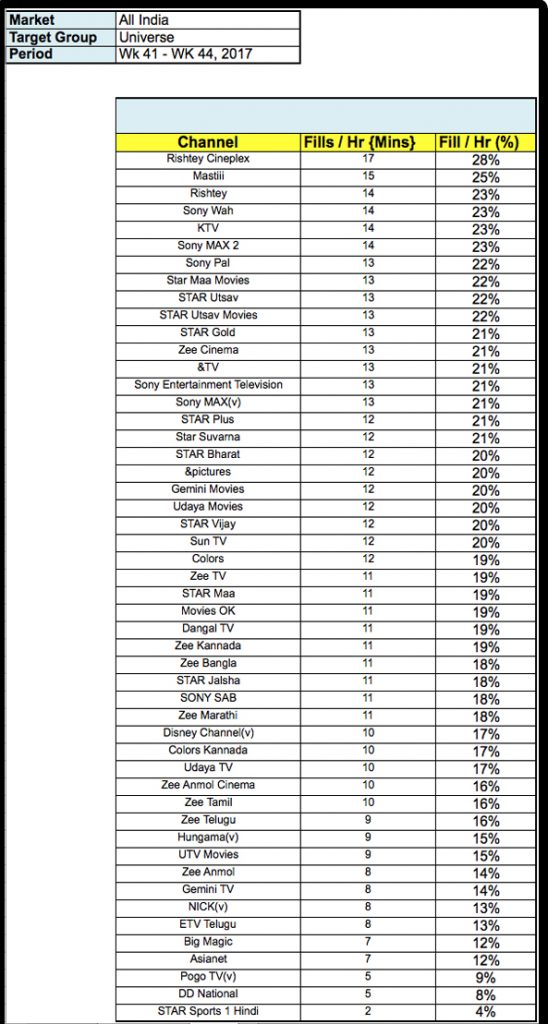

Partho, unasked, but provoked by my premise (which I shared with him), sent me a bonus: The ad fill figures. Simply put, it’s the number of minutes of advertising per hour on channels. This table paints an even more dismal figure, when you see some channels struggling to sell a few minutes of FCT per hour.

What do these numbers mean? It means that there is absolutely no inventory glut. It means that ad sales executives in the leading channels should do their homework to understand how powerful their audiences are – and how valuable their inventory is.

When it comes to the top channels in any genre, it will now appear that there is an acute shortage of ad inventory and not a glut.

Chew on this. Write with your comments; bouquets and brickbats will be acknowledged.